Service offerings

OUR SERVICES

Our service offerings include audit and assurance, tax and regulatory, corporate advisory, and corporate financing for domestic and global businesses of all sizes. We offer a range of solutions that are ideal, practical, innovative, and at par with the best that our clients would expect.

1. Audit and Assurance

Our audit and assurances service offerings are based on a complete understanding of the clients’ business specifics, industry peculiarities and the applicable laws. The audit approach is based on the compliance issues, the nature and requirement for audit, the clients’ requirement and key risk issues involved. Our audit and assurance solutions range from statutory audits, internal audits, tax audits, transfer pricing audits, management audits, concurrent audits etc.

We conduct statutory and regulatory compliance audits for filing of annual or periodic financial results. Statutory audits are aimed at achieving compliance with regulations, assessing the strength of controls, confirmation of accounting treatments of recorded transactions, independent review of reported information and preparation of accountants’ report.

We annually serve our clients in area of tax audit under provisions of Income Tax Act,1961 . Our clients are large, medium corporations and small businesses, partnership firms, non-profit organizations and high net worth individuals. The firm has dedicated audit teams which specialize in conducting the audits effectively and diligently.

The internal audits are conducted with varying client requirements but essentially the objective thereof is to provide assurance on controls and processes. We also conduct risk based management audits and also help them in defining standard operating procedures.

• “Inventory is an integral part of any organization as it is the asset of the organization which will provide gains to the business”

• The core purpose of inventory verification is to support the value of inventory as shown in financial statement along with verifying the accuracy of stock records, disclosing the possibility of fraud, theft or loss, or deterioration thereby revealing the weakness of system. It could be done at periodic intervals or perpetual verification, or surprise verification.

• Physical Verification of fixed assets.

• Barcode numbering including location, type of product, tag ID, value and other necessary information.

• Software relating to Fixed Asset support and training.

• Maintaining database and updating these with reports.

• Preparation of FAR (Fixed Asset Register).

• We are scrupulous and committed to delivering results setting you free to focus on more crucial aspects of your operations.

2. Taxation

Direct Tax

• Obtaining PAN & TAN for assessees.

• Advance tax calculation and deposit.

• Effective tax management, tax structuring, and advisory services.

• Consultancy on matters pertaining to Income tax.

• Providing regular updates on Income Tax amendments, circulars, notifications & judgments.

• Filing Income Tax returns for all kinds of assessees.

• Appearing before various authorities

• Submission of replies, rectification, assessment and obtaining refunds at Income tax department.

• Filing and pleading appeals under various provisions of IT Act.

• Tax Planning for Corporates and others.

• Search, seizure and litigation cases.

• Opinions on the various Double Tax Avoidance Agreement related issues.

• Compliance relating to TDS payments and filing of periodical returns.

Indirect Taxes

• Opinion on GST Applicability and obtaining of GST Registration.

• Review Services (Compliance Review/Area specific review/Agreementreview/Review for Statutory Auditors).

• Filing of Periodical and Annual Returns.

• Refund Services.

• Refund Services.

• Advisory and Consultancy.

• Representation and Legal Support.

• Advise the company about the reports/draft rules/Law or any other documents related to GST uploaded on Government Portal.

3. Corporate Law Services

We also provide ROC-related services commencing from advice relating to selection of appropriate status of organization to be incorporated fulfilling the business requirements to incorporation of a company, LLP, OPC to its yearly compliance of MCA Portal. DSC services are also provided.

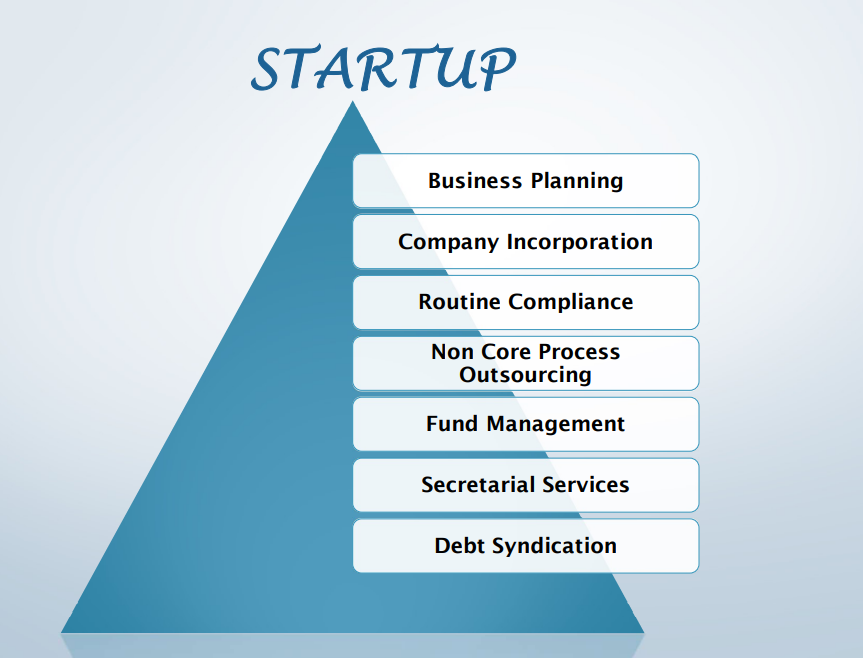

3. Start-Up Consultancy

• Cost-effective customized business planning relating to Goal Setup, strategy formulation, and implementation along with budgeting, sensitivity analysis, and assessing registrations to be obtained from several authorities.

• Fast paced company incorporation solutions beginning with DSC application, DIN Allotment, filing of e-forms like spice+, assistance in opening of bank account, name reservation, drafting of documents like MOA, AOA, share certificates and concluding with obtaining certificate of commencement of business and obtaining of startup certificate.

• Real-time support for imperative business functions like accounting, payroll, monthly financial reporting, interactive dashboard and MIS preparation, month-end closure by providing outsourced staff for conducting business processes. GST support related to assessment of tax payments, GST return preparation, review and filing. Direct Tax support related to TDS deposits, TDS return preparation, review and filing, ITR filing, tax planning Payroll support related to payment of statutory dues likes ESI, PF, Professional Tax (in few states only).

• GST support related to assessment of tax payments, GST return preparation, review and filing.

• Direct Tax support related to TDS deposits, TDS return preparation, review and filing, ITR filing, tax planning.

• Payroll support related to payment of statutory dues likes ESI, PF, professional Tax (in few states only).

• Facilitating registration with several Tax authorities, advisory services, certifications, drafting and maintaining Board Resolutions, minutes of meeting and Statutory Registers as per Companies Act, 2013, filing of necessary forms with ROC, representations, obtaining approvals from government authorities like NCLT, ROC & RBI.

• Assistance in working capital and cash flow management by cash forecasting, cost management, receivables management Fund Management.

• Drafting of Shareholder’s Agreement (SHA), Loan Agreements, Vendor Agreement, Lease/Rental Agreement and several others. Agreement Preparation.

• Outsourced CFO services for formulation of business plans, sustainability overview, succession planning, fund raising, managing & improving finance, accounting, taxation, compliance and other routine business functions.

• To assist in financial obligations by reorganizing outstanding obligations, and arranging funds for expansion/ working capital needs.

4. Accounting and Bookkeeping

Bookkeeping is the process of recording, in chronological order, daily transactions of a business entity. It forms part of the accounting information system. On the other hand, accounting is an information system– includes process of recording, classifying, summarizing, reporting, analysing and interpreting the financial condition and performance of a business – in order to communicate it to stakeholders for business decision making.

Our professional team including CA’s, accountants and administrative staff are capable of handling all your book keeping and accounting processes, from basic sale and purchase entry, payment and processing, to the more difficult duties of a CFO.

We apply stringent data / information security measures for your bookkeeping needs so that you can focus on your core competencies while we manage your bookkeeping activities. We at AMA realize the importance of being updated with accounting and are here to provide you with internationally accepted accounting & bookkeeping outsourcing services which can be utilized for various internal decision making and reporting purposes. AMA provides bookkeeping services & accounting services –weekly, monthly, quarterly and annually as per the requirement.

AMA’s bookkeeping and accounting services include:

• Setting up ‘books of account’ in required bookkeeping software / formats

• Graphical/ summarized Representation of accounts

• Categorization of income and expenses

• General Ledger maintenance

• Invoicing services

• Accounts Receivable services

• Accounts Payable services

• Preparing ageing reports and summaries

• Reconciliation services – Accounts, Bank, Credit Cards & PayPal

• Preparing Financial Statements adhering to Generally Accepted Accounting Principles(GAAP)

• Preparing and formatting Income Statement and Balance sheets on a regular basis

• Cash Flow management

• Payroll reconciliations

5. Outsourcing Finance Team

• “Master your strengths, outsource your weaknesses.”

The core activities are important part of the organization, and it controls the business. Non-core are an integral part of the business but mostly comes after the business.

• We help the management to focus on the core business by providing a one-step solution for all the finance needs be it from Accountant to compliance of GST & TDS.

6. Project Financing

• Finance is the backbone of a business to run day today operations as well as expansion. Project Finance is the preferred finance mechanism for large infrastructure projects that are essential for growth of any company.

• Keeping this in mind, we provide following services:

Working Capital Financing

Unsecured Business Loan

CIBIL Report

Loan against Property

Business Plan Assistance

Finance Project Report

Risk & Financial Management

7. IndAS Conversion

The Indian Accounting Standards (IND AS) are Accounting Standards, harmonized with IFRS (International Financial Reporting Standards)/IAS (International Accounting Standards) to make Financials Accounts and Reports of Indian Companies internationally accessible, acceptable, transparent and comparable.

OUR SERVICES :

Conversion of financial statements prepared under Indian GAAP to IND-AS.

Preparation of Expected Credit Loss (ECL) model for companies.